As More than just a car maker, Tesla manufactures electric vehicles (EVs) and provides energy solutions. Since Tesla’s visionary CEO Elon Musk entered the scene, the automotive industry was transformed, and sustainable transportation has become the narrative. As a result, Fintechzoom Tesla Stock has grown in popularity and volatility. Fintechzoom Tesla Stock analysis gives valuable insight into the company’s rapid growth, innovations, and their impact on its shares.

The purpose of this comprehensive article is to discuss the Tesla stock price in addition to examining the reasons behind the company’s innovations and how they impact its stock price. Next, we will examine how Fintechzoom Tesla Stock financial results.

Table of Contents

Dominance of Tesla’s market

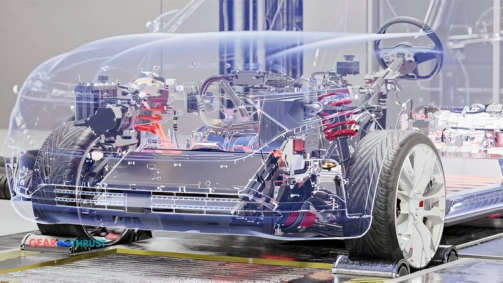

The electric vehicle (EV) technology developed by Tesla has revolutionized the automotive industry. It has dominated the EV market through its position as the first major player and maintained a significant lead over its competitors. Both retail and institutional investors have been attracted to Tesla’s growth and high stock prices.

As Tesla transitions to renewable energy, it has a vision that extends beyond only cars. Investors who see the company’s potential to improve not just the automobile industry but the entire energy industry have become more interested in its battery technology, solar products, and self-driving software innovations.

Investing in Tesla shares depends on its car innovations

It The relationship between Tesla’s stock price and its technological advancements is undeniable. Tesla’s market valuation grows significantly as a result of its innovative vehicle models, battery and software advancements, and autonomous driving. In order to keep up with this volatility, Fintechzoom Tesla Stock provides real-time performance updates online.

Stock prices and Tesla’s Car Innovations

Tesla has been at the forefront of the electric vehicle revolution due to its ability to innovate continuously. Its advancements in autonomous driving technology have made it a symbol of the future of mobility, with new models like the Tesla Model 3 and Cybertruck capturing global attention.

Innovations in electric vehicle range and technology

Tesla’s electric vehicles have always been able to offer a longer range than their competitors. With vehicles like the Tesla Model S that offer over 400 miles on a single charge, EV manufacturers such as Tesla have set the bar for EV range. These breakthroughs in battery efficiency directly affect Tesla’s share price due to the growing consumer demand for electric vehicles.

When Tesla announced its breakthrough in battery technology, for example, investors realized that Tesla could dominate EVs and energy storage worldwide. Tesla vehicles will be more appealing as new batteries become more affordable.

Live Updates of Fintechzoom Tesla Stock

Technologies for autonomous driving

A key innovation of Tesla is its autonomous driving technology. Fully autonomous vehicles are a step forward thanks to Tesla’s Full-Self Driving (FSD) system. In contrast, competitors are still developing similar over-the-air technology, which is regularly updated and refined.

Fintechzoom Tesla Stock and Autonomous Driving

Investors are enthusiastic about the potential revenue streams from self-driving software as Tesla moves closer to producing fully autonomous vehicles. As Tesla’s FSD system is improved, Tesla’s stock often experiences a price jump.

Although things are going well, there are some hiccups. Tesla’s stock price can sometimes dip due to regulatory hurdles and safety concerns, especially when accidents involving self-driving vehicles make headlines. The stock of Tesla is affected in real-time by news reports on platforms like Fintechzoom, which monitors these fluctuations.

Also Read: Make1M Luxury Car Brands

Solutions for energy storage and battery technology

Beyond automobiles, Tesla has innovated in a variety of fields. The company is a leading player in renewable energy due to its technological leadership and energy storage solutions. Powerwalls and Powerpacks are two of Tesla’s energy storage systems, which use the company’s batteries.

Stock Performance and Gigafactories

With Tesla’s Gigafactories, batteries and vehicles are manufactured at scale in order to meet growing demand. Tesla’s factories help the company reduce costs and increase production volume so that it can become profitable and increase stock value.

When new Gigafactories are announced, such as the one in Berlin, stock prices often spike. In response to the growing global demand for electric vehicles, analysts believe Tesla has strengthened its production capacity.

Fintechzoom Tesla Stock Tracked

Tesla’s stock performance can be tracked using Fintechzoom, a financial analysis platform. This platform provides investors with real-time data, latest news, and user-generated insights that can help them make informed decisions.

Watch Fintechzoom Tesla Stock features

In addition to providing real-time Tesla stock tracking, Fintechzoom also provides expert analysis, market updates, and user comments. By aggregating news and analysis from a variety of sources, the platform makes it easy to invest in Tesla stock.

Predictions and insights based on community input

Fintechzoom’s community-driven insights are one of its most notable features. It adds an additional layer of information to traditional expert opinions by allowing investors to share their predictions and analyses of Fintechzoom Tesla Stock. In order to evaluate Tesla’s potential future growth, professional and amateur analyses are helpful.

Read more about Make1M Luxury Cars

Investor Sentiment and Fintechzoom

Because Fintechzoom is a real-time platform, investment sentiment changes quickly. Tesla’s stock is especially sensitive to these changes because of Elon Musk’s high-profile behavior. A platform such as Fintechzoom can sometimes increase stock movement because it makes quick decisions based on the latest updates.

Volatility reasons for Fintechzoom Tesla Stock

In order to keep Tesla stock volatile, several key factors must be taken into account. Investing decisions can be more informed by understanding these factors.

Stock prices and Elon Musk

Elon Musk is a major factor in Tesla’s stock price. The tweets he posts and ambitious projects he takes on have the ability to move markets. The tweets Tesla’s CEO makes are able to influence the stock price, whether they announce a stock split or make controversial remarks.

A number of Musk’s ventures outside of Tesla are The Boring Company, SpaceX, and Neuralink. As Musk’s broader ecosystem grows, success in one venture can impact Tesla’s valuation.

EV market competition

There is intensifying competition among EV manufacturers, despite Tesla’s dominance. Traditional automakers such as Ford and General Motors are ramping up their efforts to produce electric vehicles, and companies such as Rivian, Lucid Motors, and NIO are making significant progress.

Tesla’s stock price may fluctuate as a result of this growing competition, which can lead to uncertainty about its future market share. Any signs of market share erosion can result in Tesla’s stock price declining as investors watch Tesla’s ability to maintain its lead against increasing competition.

Changes in global regulation

Tesla’s stock price may also be affected by changes in government regulation, such as emission standards and incentives for electric vehicles. There are a variety of incentives and subsidies available from governments around the world to encourage the use of electric vehicles.

Tesla’s progress can be hindered by regulation challenges, such as more stringent safety standards. The stock price of Tesla may be affected by regulatory delays.

Tesla Stock’s Long-Term Growth Prospects

It is believed that Tesla could not only revolutionize transportation, but also energy consumption in the long term, which is why long-term investors favor the company.

Alternative energy: transitioning to it

As renewable energy takes hold globally, Tesla is well positioned to take advantage of its ventures in solar energy and energy storage.

Along with its car production, Tesla is known for its solar products, such as its Solar Roof and solar panels.

In The world’s shift towards greener energy has also given Tesla a competitive advantage.

Autonomous vehicles can dominate the market

The company’s push toward full autonomy could lead to new revenue streams such as robotaxis and autonomous freight transportation. The potential dominance of Tesla in the autonomous vehicle market is another reason investors are bullish on the company.

Conclusion about Fintechzoom Tesla Stock

Not only in the automotive industry, but also in the stock market, Tesla has made a name for itself with its innovations in electric vehicles, autonomous driving, and renewable energy. To keep track of Tesla’s often volatile stock price, Fintechzoom Tesla stock analysis is crucial.

Fintechzoom gives you valuable insight into Tesla’s stock performance, regardless of whether you are an experienced investor or just starting out. It provides investors with real-time updates, community-driven insights, and expert analysis so they can make more informed investments in Tesla’s stock.

Related Articles: